Become A Social Media Rock Star In Four Easy Steps [Infographic]

October 10, 2013

The One Question That Is Shaping Your Entire Life

November 5, 2013What would you do if 37% of your business evaporated overnight?

Since mid-August, Regional banks and Mortgage originators have been facing a scary near-term prognosis. Scores of banks will likely suffer double-digit declines in mortgage revenue in the second half of 2013, according to Sterne Agee. Mortgage Bankers Association is betting the decline will be 37%.

To make matters worse, the cost of compliance continues to mount every month—add to that declining volumes, excess capacities and more competition than ever and you have a compelling leadership challenge.

How can mortgage leaders triumph in these tricky times?

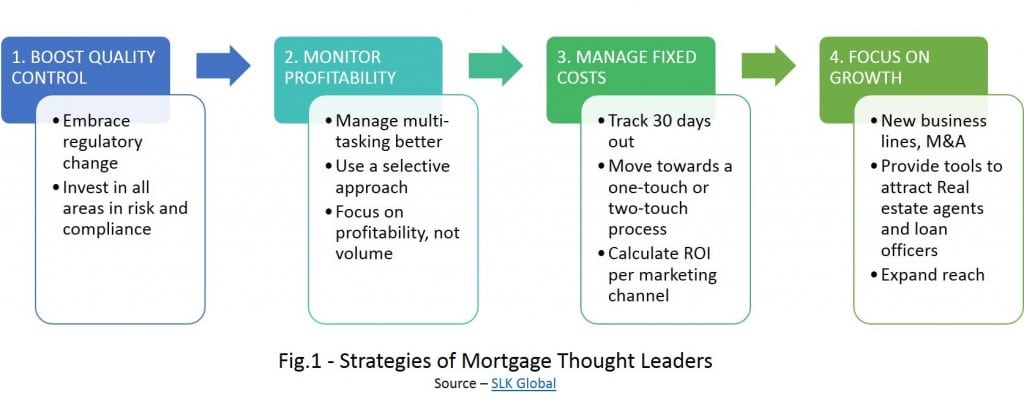

Image Credit: SLKGlobal

My client SLK Global (@slkglobalsvcs) and I were considering how the mortgage industry has provided a fascinating case study for how leaders adapt in times teetering on crisis. They interviewed some of the top Mortgage industry thought leaders to distill their best practices. Here’s what they are:

1. Boost Quality Control To Handle Compliance And Regulatory Changes

Joseph Panebianco, CEO and President at Annie Mac Mortgage:

- Embrace the regulatory changes earlier than later. You might lose some market share initially, but then you will be able to gain that market share back regardless of the interest rate environment.

- Take a consultative approach with your borrowers so they understand the many steps that are required to make sure everything is 100% compliant.

Willie Newman , President – Mortgage Division at Cole Taylor Bank:

- We need to invest in all areas in risk and compliance. To deal with compliance we are really broadening the awareness about compliance. Every employee of the organization at any level needs to have some knowledge of the regulations or compliance.

Donald Calcaterra, Jr , President at Towne Mortgage Company :

- Our chief compliance officer is active in industry, regulatory and legislative circles to ensure our client’s needs are served and changes are implemented before effective dates

2. Monitor And Streamline Profitability With Rising Interest Rates

Roy Jones, CEO at Georgetown Mortgage:

- Break down the processing job in several job descriptions. We have divided the processing function into three different jobs to get more efficiency and productivity because we found that processors were multitasking too much.

- And we are also working towards the same for our underwriting staff as well. Greater consistency, greater speed and greater accuracy can be achieved by doing this!

Joseph Panebianco, CEO and President at Annie Mac Mortgage:

- Rising interest rates are going to have a significant effect on the consumer’s ability to buy. What is more concerning though is the speed and the ferocity at which we have reached the current level of interest rates. When faced with significant and rapid change most people tend to freeze–they won’t act. Whereas the whole organization is looking at exactly the opposite and they need guidance and directions from their leader.

- What is the volume goal for this year? is the wrong question. It should be What is your profitability goal for the year? If in our attempt to grow, the marginal loan becomes unprofitable, we simply will not do it.

3. Manage Fixed Costs Efficiently

Eric Bowlby, President at Amerifirst Financial:

- As soon as the decline started we began to track our numbers closely for the next 30 days. So we know how volumes are going to go and make appropriate staffing adjustments. We feel that you should let go of anybody that you won’t need 30 days in the future.

- Companies that are doing large amount of re-finance business have the tendency to go out of business. We have maintained our focus on the purchase business and so have been relatively less affected.

Roy Jones, CEO at Georgetown Mortgage:

- We are constantly reinventing our loan manufacturing process, i.e. getting close to one touch or two touch processes. The goal is that the loan should be in best possible shape before it reaches the underwriter. Then it requires far less examination—and cost—to us.

- Because the loan quality is very high, coming in, we are able to deliver more productivity and better better efficiency. 70% of our cost is human resource. So making human resources as productive as possible is the best thing we can do.

Joseph Panebianco, CEO and President at Annie Mac Mortgage:

- We reward people very heavily on the upside—and make sure they understand that when the volumes are down they need to shore up and chip in more. We have a variable cost model unlike many of our competitors. So in boom times we pay more, but when volumes are down we end up paying less.

- You’ll want to control your marketing costs by calculating your ROI on each channel. Then you can develop a hierarchy of where to spend your capital best. So when you need to cut back, you know that you are cutting back on marginal cost while keeping your best performing marketing channel going.

4. Focus On Customer Acquisition

Stan Middleman CEO at Freedom Mortgage:

- Our business in response to rising interest rates will have reduced production. We are attempting to increase market share by competing stronger on price and becoming more efficient in operations to drive down its costs. The net effect is smaller margins. The target though is to get a bigger piece of the shrinking pie.

- We have invested in acquiring mortgage servicing rights. In the last year we have expanded our reach to almost 200,000 customers compared to about 100,000 the same time last year. This way we get paid irrespective of how many new clients we create.

- We have developed new business lines that allow us to get revenues in less interest-sensitive environments. We are investing in commercial mortgage spaces as well as in specific M&A activity to support our growth plans.

Eric Bowlby President at Amerifirst Financial:

- It’s all about the tools you have. You need tools to attract real estate agents. You need tools to attract loan officers. We use CE hours to meet real estate agents. We have created a comprehensive platform where a real estate agent can build a single page website where they can create a webpage for the property they have listed or the listing they wish to win. So they have greater chance to find the buyers since 85% of potential buyers today go to the internet first. We do a lot to help real estate agents and loan officers get more business.

Donald Calcaterra, Jr , President at Towne Mortgage Company:

- Regulation is effectively nationalizing the industry. Our challenge is to provide community lending solutions in a regulatory world that believes one size fits all

How is your business doing? Where can you streamline, optimize and add more value?