Image Credit: wdt.edu

Are you slaving away, building a business with no plan or process or path to one day cash out?

If so, I think I know why:

1) You’re so busy running your business you don’t have time to plan your exit, or

2) You’ve likely not built a business that you’ve sold for many millions, or if you have, you’ve likely not done it 5 times yourself and helped others do it 50 times so you’re not sure what the process is.

Why and When to Sell

Every week CEOs call me asking for help in growing their business. The majority want to one day sell all or a portion of their company either to outsiders or their own team. Why sell?

Reason #1: The Seven D’s

Generally I find Founders want to sell their company when one or more of the famous “D”s are present: disenchantment, disability, disagreement, disintermediation, (excessive) debt, death, divorce, disease. “When one or more of these ‘Ds’ are in play we can be assured that a business owner is interested in divesting of his or her business’” says Guy Beaudry, Managing Director, STS Capital.

If you’ve got one or more of the Seven D’s it’s time to sit down with a trusted advisor to explore your options. One of them will likely be able to start grooming your business to sell for top dollar, starting now. Keep reading to learn how.

Reason #2: Opportunity Knocks: Private Equity Version

Since the beginning of 2012 and even going back to the second half of 2011, an increasing amount of capital has become available, especially from private equity groups who are coming under pressure to invest the funds they’ve been sitting on. Funds that are in year 2 or 3 of their investment cycle and have only deployed a small portion of their capital are especially in trouble.

How big is the Private Equity overhang? $400 Billion. Yes, friends, there’s in excess of $400 Billion of capital needing to be deployed. These funds better get busy.

Reason #3: Opportunity Knocks: International Version

On another front we are witnessing an increased desire by Asian investors, especially the Chinese and the Japanese, to invest abroad–and in especially the Americas. STS Capital Partners is actively involved in providing Asian buyers with opportunities to invest with a typical range of investment from $100 million and up. Hmm… could take care of one’s expansion capital needs, yes?

Reasons #4-6: Reality Check (aka What Matters to the Market)

In addition to the three reasons above, let’s overlay the Reality Check reason on top. Atlas Capital Strategies lists three:

A) the market for your business/industry is currently drawing a lot of attention with strong market valuations;

B) your company is growing and posting modest revenue and earnings growth and your industry is experiencing moderate M&A activity with “reasonable” valuations or

C) your industry is out of favor with acquirers/investors or a particular company is struggling to grow and can expect anemic valuations.

Should You Stay or Should You Go?

Based on which of the above is true for you, here are your alternatives:

- (Go or Stay) Sell the entire company: appropriate for category “A” above to allow you to retire, stay for a term to see if it’s still fun, or move on to your next venture; or

- (Stay) Sell part of the company: ideal situation for category “A” and “B” to get partial liquidity now and continue to drive your business to the next level to reap a greater payday in the future; or

- (Stay) Acquire another company: suitable for any of the three categories to boost topline growth and improve earnings for the combined entities; or

- (Stay) Focus on organic growth: all companies can benefit from such a strategy, however, categories “B” and “C” have a more pressing need to assess core product/service offerings, realign the organization and better manage expenses to prepare to sell when the market improves for your industry.

You Can Always Get What You Want

Another great point my friends at Atlas Capital Strategies makes is that before you execute an engagement letter with your advisor be sure to articulate your ideal legacy. Consider these two key factors:

- What you need: This is the rational goal to understand how much money is required, on an after-tax basis, for you to accomplish your goals.

- What you want: Three highly emotional issues are then addressed that create the true legacy for you as the business owner.

- Your role: You may desire to remain with the business as CEO to “take the business to the next level”; or you may want to be named Chairman so you can still be involved; perhaps you wish to limit your operating role to one facet of the business such as sales or product development; or, like many, you want to exit completely as quickly as possible following the sale and transition.

- What happens to your employees: Do you want to protect each and every employee with zero layoffs; do you recognize some reductions in the workforce are inevitable to improve the efficiency of the business; or, are you okay with wholesale reductions-in-force to take advantage of synergies when merging with a larger entity (this often results in a very high valuation for the business as well).

- What happens to the entity: The two outcomes here are whether the business remains an independent operating entity (or subsidiary) or the people, products/services, IP and other assets are simply absorbed by an acquirer with the original entity being dissolved. Companies with little brand equity in their niche usually consider a sale to a larger, more successful enterprise to be highly beneficial for their customers and employees.

So let’s say that you’ve decided you want to sell, and you’ve made the serious decisions above. Now let’s cover the proven process.

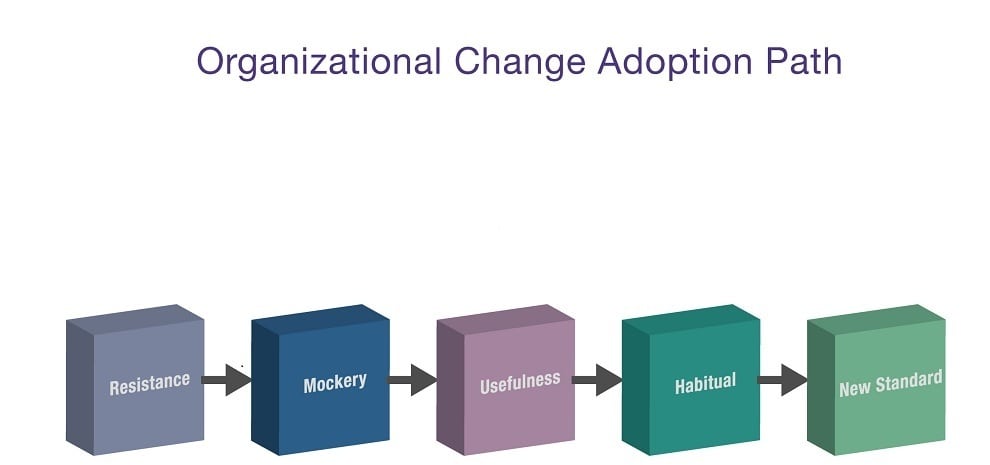

The Net-Net On Boosting Value

In the 50 companies I’ve help build to sell, with purchase prices ranging from $12 million to $425 million, there are 6 key essential steps to a glorious liquidity event.

1-Motivation: Design your business to be sold for the amount you want, on the terms you want, at the time you want.

2-Momentum: Get and keep massive momentum so your company grows quickly yet sanely, increasing its value to acquirers on a monthly basis.

3-Model: Develop a business model that is scalable, has defensible diversity, and is supported by efficient operations to optimize profit.

4-MVPs: Create a high performance team that consistently delivers results and innovation to boost your company’s value.

5-Money: Develop a sales and marketing process and strategy that delivers compelling and reliable revenue to your company—year over year.

6-Mentor: The right influential advisors and alliances who’ll raise your profile with potential acquirers and significantly increase your company’s credibility and thought leadership.

Ultimately the goal is to make your company irresistible to potential acquirers. Let’s say that you have a fantastic, seasoned executive coach and they are helping you and your team with the above. Wonderful. (And if you don’t have one, get one now!).

Cash Out or Hold Out—what’ll it be? If you’re considering cashing out and your revenue is over $20mil, apply for a Build to Sell Strategy Call by clicking here.

Christine Comaford has built and sold 5 of her own businesses for multiple millions, and she has advised over 150 CEOs in building their own businesses to sell. 50 of those companies have been sold for $12-425 million. As an angel investor Christine has invested in over 200 companies, including Google, Zip Realty, Motiva, Seesmart,and many other businesses that were built to sell.